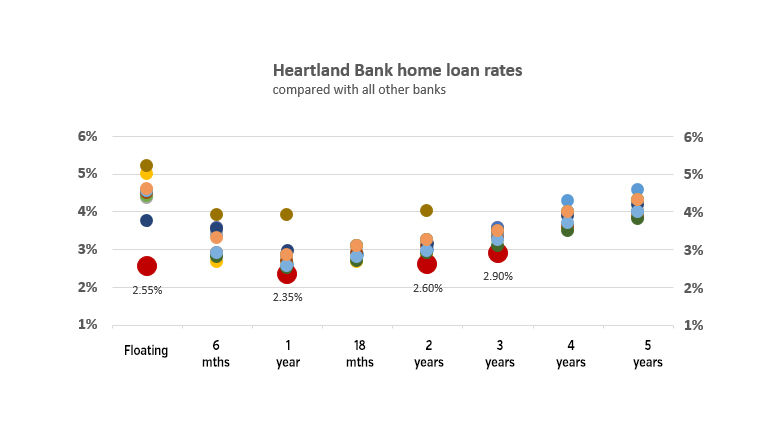

Improved affordability, lowest interest rate on record, pushing demand for home loans

Favorable demographics, better affordability of residential properties and historically low mortgage rates are boosting demand for home loans, mortgage lenders have said. Several major banks, mortgage lenders and housing finance companies significantly reduced their mortgage interest rates during the festival period to take advantage of the resumption in housing demandRead More →