The lowest mortgage market rates have now been raised.

Heartland Bank added +30 basis points to its very competitive floating rate. And he also increased all of his fixed rates.

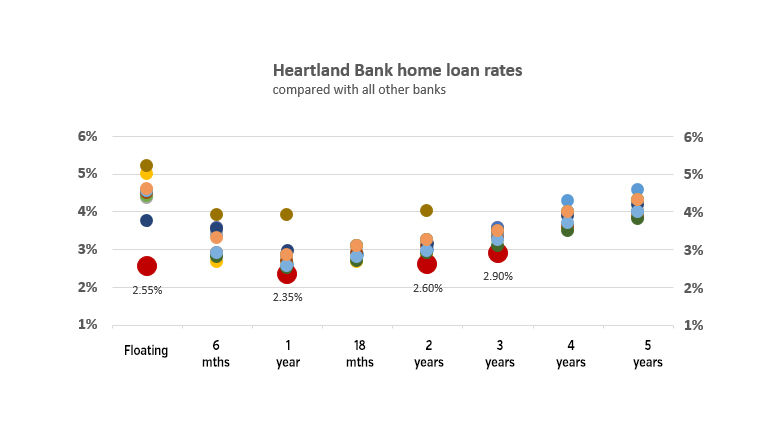

Heartland’s floating rate fell to 2.55%, but it’s still around 2% lower than any major Australian bank and 1.20% lower than Kiwibank.

Its one-year fixed rate rose +20 basis points to 2.35% but remains the lowest among all banks (with the exception of SBS Bank’s first “special” buyer).

Heartland’s two-year fixed rate is up +15 basis points to 2.60%, and it’s still the lowest bank rate for this term as well.

Its three-year fixed rate was raised by +25 basis points to 2.90%, again the lowest of all banks for this fixed term.

Overall, Heartland Bank rates remain 50 to 60 basis points lower than those of major banks.

But Heartland low rate home loans come with some direct requirements and conditions. You must have at least 20% equity or deposit, live in the property, and be able to meet payroll or salary repayments (therefore, no help from others is allowed). In addition, the house must be a single-section, free-standing, cross-lease or unit title free-standing house, located in an urban center, not in trust, and already built. And the house cannot be a monolithic or plastered property granted before January 1, 2006.

If you can meet these conditions and the bank’s credit conditions, you can apply – online.

Heartland does not currently work with mortgage brokers for home loans.

Wholesale rates continue to rise, although over the past few days the short end of this market has been leveled.

Financial markets have now forecast a full rate hike of +25bp during the next Reserve Bank review on Wednesday, October 6. And they expect a steady series of similar increases over the remainder of 2021 and 2022. Some still believe there could be a +50 basis point hike somewhere, although it is unlikely that this will be. into 2021. Much depends on how the 2021/2022 housing market responds to pent-up demand pressures that lockdowns may have built up.

And to some extent, it depends on how intense these pressures are on the balance sheets of some households that may have to sell during the pandemic crisis, especially SME owners. There haven’t been any real signs of overall credit stress in the data yet, but it wouldn’t be surprising if there are as the situation evolves.

A useful way to understand these modified home loan rates is to use our complete mortgage calculator which is also below. (The rates for term deposits can be estimated using this calculator). (Our calculators are all operational again now.)

And if you already have a fixed-term mortgage that is not currently up for renewal, our break cost calculator can help you assess your options. But breakage fees should be minimal in a rising market.

Here is the updated snapshot of the lowest advertised term mortgage rates currently offered by major retail banks.