10 tips to increase home loan eligibility – Forbes Advisor INDIA

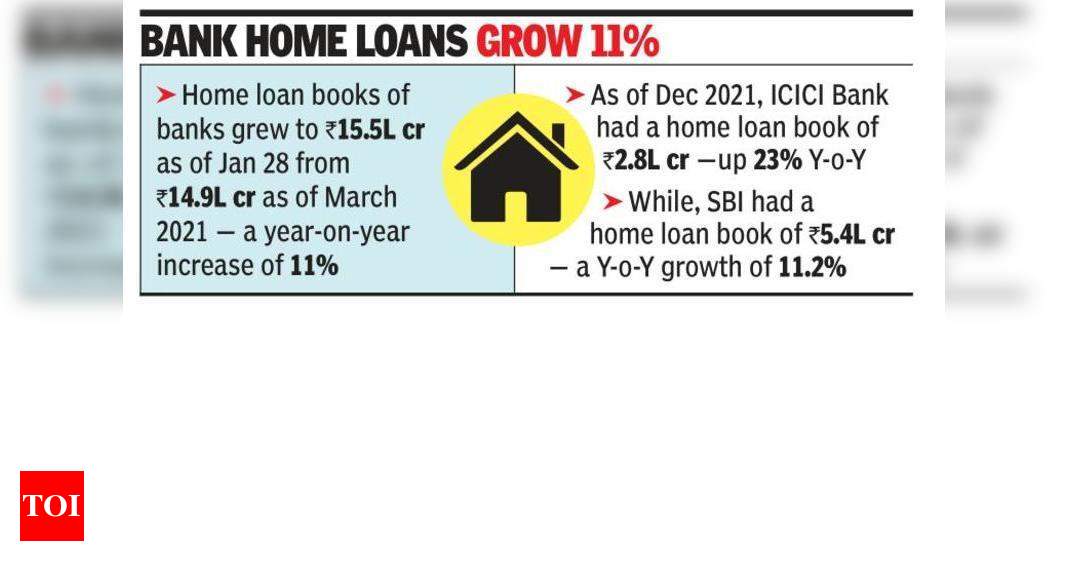

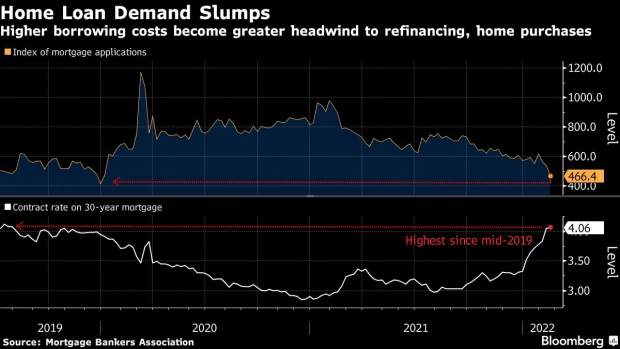

Housing affordability has risen sharply over the past two years, with housing rates falling and interest rates on loans falling to their lowest levels. So if you’re considering buying a home, chances are you want to get as much loan as possible. If you are a first-time home buyer, qualifyingRead More →