Mumbai: The country’s largest mortgage company, HDFC, said it approved more than Rs 2 lakh crore in individual home loans in the financial year March 22-21 – the highest ever in a financial year . This is a 30% increase from loans worth Rs 1.55 lakh crore sanctioned in FY21. Demand for these loans comes from across the country and is driven by the affordable housing.

According to Renu South Karnad, MD, HDFC, the growth was high given that last year there was a pick up in demand due to stamp duty and other incentives provided by the state government.

FY21 also saw demand for loans under a government credit-linked subsidy program, which was available for homes up to a certain size, regardless of value.

In January, loan sanctions took place despite the Omicron variant disrupting office operations as staff were stuck with Covid. However, the company has managed to continue serving customers using digital channels.

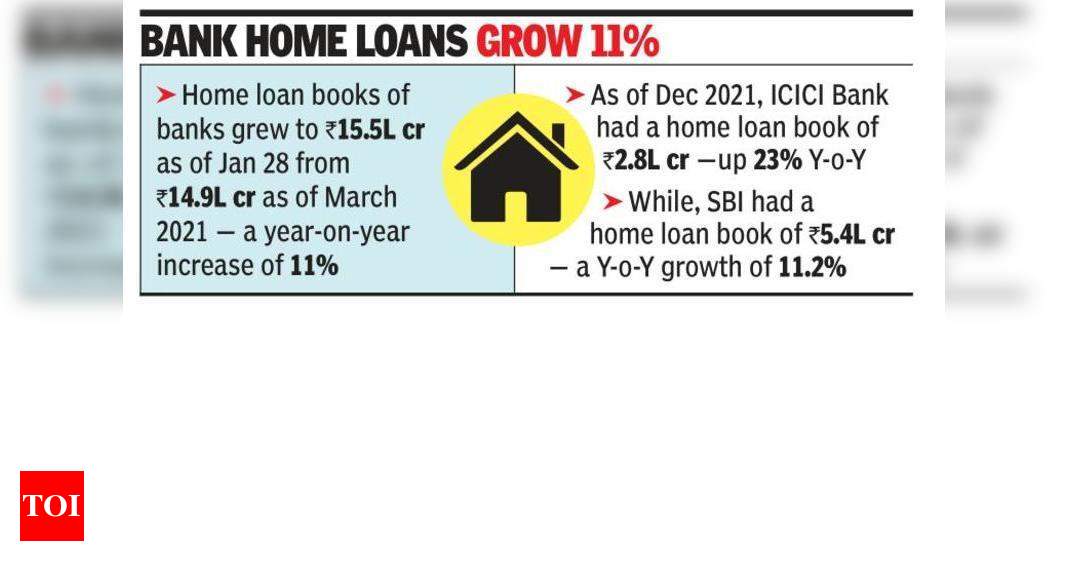

According to data released by RBI, the mortgage books of banks increased from Rs 14.9 lakh crore at the end of March 2021 to Rs 15.5 lakh crore as of January 28, 2022. The year-on-year growth of the housing loan portfolio for the banking sector was 11%. As of December 2021, ICICI Bank had reported a home loan portfolio of Rs 2,78,267 crore – a 23% year-on-year increase. SBI, which holds the largest home loan portfolio of Rs 5,38,475 crore as of December 2021, recorded a year-on-year growth of 11.15% in its loan portfolio. Although the sanctions cannot be compared to the growth of the loan book, there are indications that HDFC may have increased its market share in the fourth quarter.

“In more than four and a half decades, I have not seen a better time for the housing sector than today due to lower interest rates, stable house prices, government push on affordable housing, improved affordability, favorable demographics, increasing urbanization and rising aspirations,” Karnad said.

She added that CLSS programs under the PMAY (PM Awas Yojana) have helped move towards the goal of “housing for all”. “The residential real estate segment will continue to see strong traction going forward, as housing demand is not just pent-up demand, but structural,” Karnad said.

She added: “Over the past year, we have seen a strong pipeline of new launches surpassing pre-pandemic levels. Housing demand continues to come from new homeowners as well as those moving up the ownership ladder, typically in larger homes. We are seeing healthy demand in metros and non-metros and demand is widespread in the affordable and premium markets. The sweet spot for housing is still in the price range of Rs 50 lakh to Rs 1 crore.

According to Karnad, affordable housing will continue to drive the real estate sector in India. “The demand for affordable housing in India is extremely deep and resilient. With more developers moving into the mid-market and affordable segment by providing right-sized, right-priced units that are affordable to end users, the affordable residential real estate segment will continue to see strong traction,” he said. she declared.

According to Renu South Karnad, MD, HDFC, the growth was high given that last year there was a pick up in demand due to stamp duty and other incentives provided by the state government.

FY21 also saw demand for loans under a government credit-linked subsidy program, which was available for homes up to a certain size, regardless of value.

In January, loan sanctions took place despite the Omicron variant disrupting office operations as staff were stuck with Covid. However, the company has managed to continue serving customers using digital channels.

According to data released by RBI, the mortgage books of banks increased from Rs 14.9 lakh crore at the end of March 2021 to Rs 15.5 lakh crore as of January 28, 2022. The year-on-year growth of the housing loan portfolio for the banking sector was 11%. As of December 2021, ICICI Bank had reported a home loan portfolio of Rs 2,78,267 crore – a 23% year-on-year increase. SBI, which holds the largest home loan portfolio of Rs 5,38,475 crore as of December 2021, recorded a year-on-year growth of 11.15% in its loan portfolio. Although the sanctions cannot be compared to the growth of the loan book, there are indications that HDFC may have increased its market share in the fourth quarter.

“In more than four and a half decades, I have not seen a better time for the housing sector than today due to lower interest rates, stable house prices, government push on affordable housing, improved affordability, favorable demographics, increasing urbanization and rising aspirations,” Karnad said.

She added that CLSS programs under the PMAY (PM Awas Yojana) have helped move towards the goal of “housing for all”. “The residential real estate segment will continue to see strong traction going forward, as housing demand is not just pent-up demand, but structural,” Karnad said.

She added: “Over the past year, we have seen a strong pipeline of new launches surpassing pre-pandemic levels. Housing demand continues to come from new homeowners as well as those moving up the ownership ladder, typically in larger homes. We are seeing healthy demand in metros and non-metros and demand is widespread in the affordable and premium markets. The sweet spot for housing is still in the price range of Rs 50 lakh to Rs 1 crore.

According to Karnad, affordable housing will continue to drive the real estate sector in India. “The demand for affordable housing in India is extremely deep and resilient. With more developers moving into the mid-market and affordable segment by providing right-sized, right-priced units that are affordable to end users, the affordable residential real estate segment will continue to see strong traction,” he said. she declared.