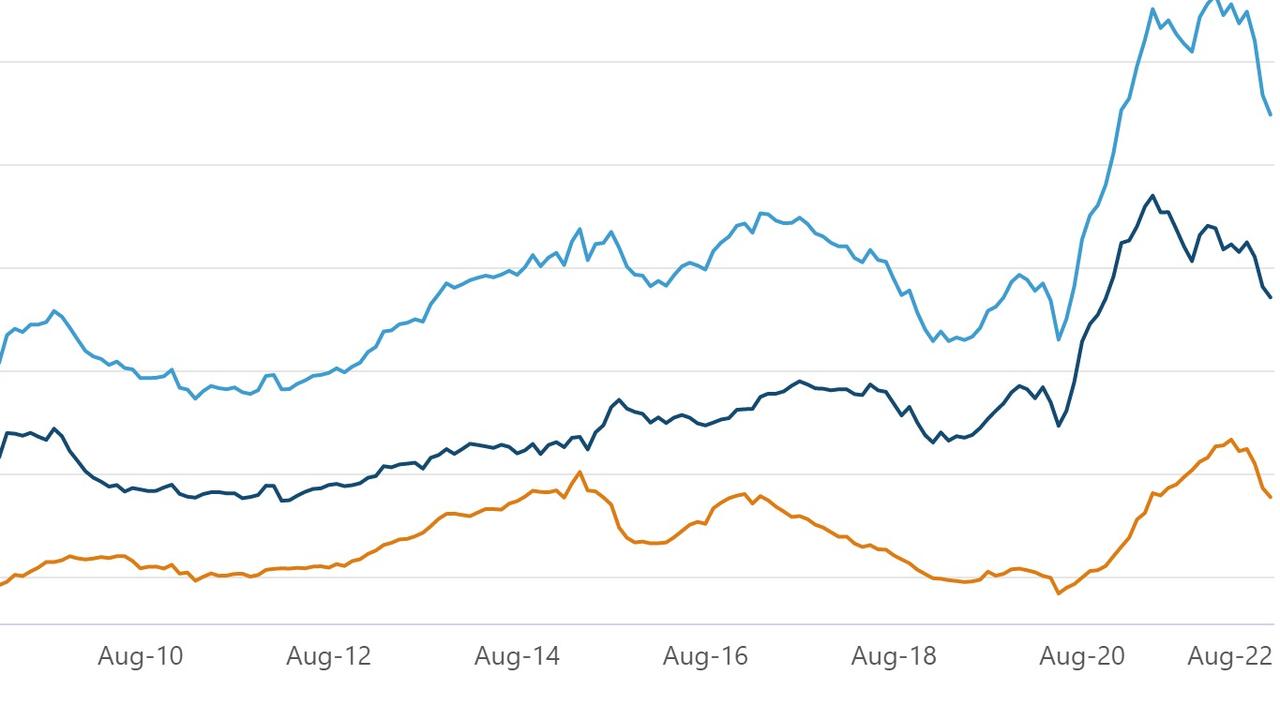

The value of new home loan commitments fell 3.4% to $27.4 billion in August, new data showed.

It comes after an 8.5% plunge in July, according to the Australian Bureau of Statistics.

“The value of new loan commitments to homeowners fell 2.7% in August 2022, and the value of new loan commitments to investors fell 4.8%,” said Katherine Keenan, chief financial officer and wealth at ABS.

“Although loans continued to decline from the high levels of June 2022, the value of loan commitments in August remained elevated compared to pre-pandemic levels.

“Loans to homeowners in August were 36% higher than February 2020, while loans to investors were 70% higher.”

New loans to first-time homeowners rose 10.4% in August to 9,258 – the biggest rise since August 2020.

However, that was still well below the January 2021 high of 16,330.

Demand increased across most of the country, particularly in Victoria (up 11.9%), Queensland (up 14.3%) and Western Australia (up 13.9%). ).

“Anecdotal comments attributed some of the increased August homeowner demand to the 2022-23 first home warranty,” Ms Keenan said.

The value of borrower refinancing of owner-occupied home loans between lenders rose 2.8% in August to a new record high of $12.8 billion.

The average loan size for owner-occupied homes rose from $609,000 to $589,000 — but that’s still 23% higher than in February 2020.

Meanwhile, apartments were behind August’s rise in construction approvals.

The total number of approved homes rose 28.1%, following an 18.2% drop in July.

“Approvals for private sector housing, excluding houses, rose 99.1% in August, with a sharp rebound in apartment approvals driving the result,” said the head of statistics. of ABS construction, Daniel Rossi.

“The strong upward movement in August follows a weak result in July, which had the lowest number of other residential units approved since January 2012.

“Approvals for private sector homes rose 4.1% in August, following a 0.8% increase in July.”

THE STATE DISTRIBUTION OF HOUSING APPROVAL INCREASES

- New South Wales – 70.6%;

- Victoria – 19.4%;

- WA-13.6%;

- Queensland – 9.5%;

- Tasmania – 3.9%; and

- South Australia – 3.5%.

Data on approvals for private sector homes was more varied, with NSW (12.7%), WA (8.9%) and Victoria (1.2%) increasing, but South Australia (-4, 5%) and Queensland (-0.1%). ) to fall.

The value of total construction approvals rose 23.5%, following a 14.8% drop in July.

The total value of residential buildings increased by 28.5% – 32.6% for new residential buildings and 5.4% for alterations.

The value of non-residential buildings rose 15.1%, after falling 21.5% in July.

The ABS data comes as the Reserve Bank of Australia announced on Tuesday it was raising the cash rate target by 25 basis points to 2.60%.

It also increased the interest rate on foreign exchange settlement balances by 25 basis points to 2.50%.

Governor Philip Lowe said it was a necessary move to bring inflation down and the board expected to raise interest rates further in the coming months.

“He closely monitors the global economy, household spending and wage and price setting behavior,” he said in a statement.

“The size and timing of future interest rate increases will continue to be determined by incoming data and the board’s assessment of the outlook for inflation and the labor market.”