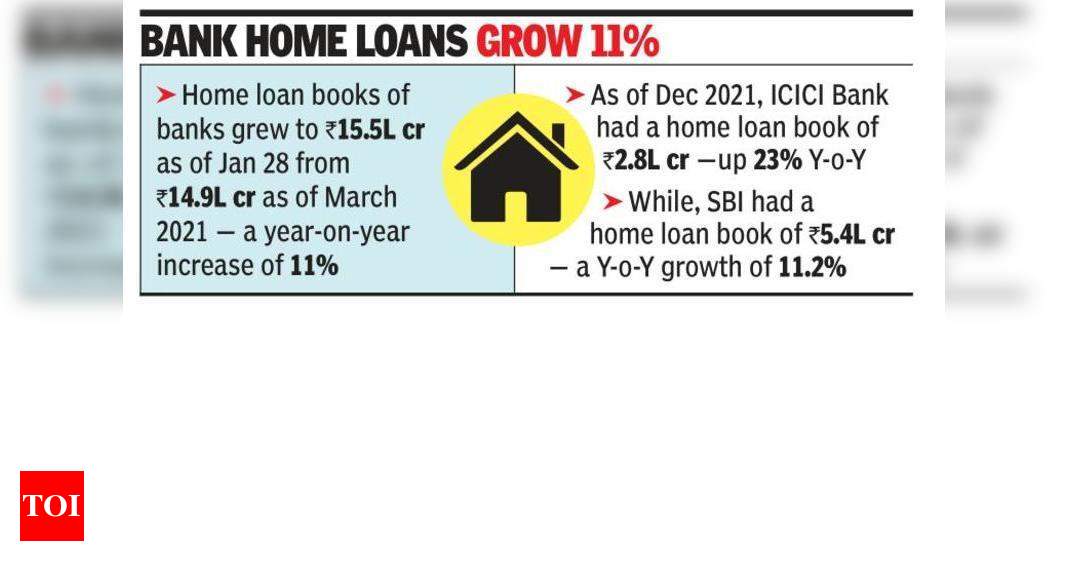

Increase in mortgage repayments

With prices rising for everything from petrol to canned vegetables, and now interest rates rising, are homeowners in Western Australia ready for changing economic conditions? A Bankwest analysis of mortgage repayments found that increased savings and low interest rates throughout the COVID-19 pandemic have put homeowners in better financial shapeRead More →

:quality(70):focal(-5x-5:5x5)/cloudfront-ap-southeast-2.images.arcpublishing.com/tvnz/PJA2MMMYZFCB7NXO3T4ZT7GX2I.jpg)

/GettyImages-1311546186-bcbce3839b544ec1b3115552c20b8b52.jpg)

:quality(70):focal(-5x-5:5x5)/cloudfront-ap-southeast-2.images.arcpublishing.com/tvnz/G6AEHLRASNDZJF7WKHIMYDZSA4.png)